Financial Planning & Succession Plans for Farmers

By: William Henriksen, CFP®

Farmers play a vital role in our society, providing food and sustaining our communities. However, there comes a time when farmers may start thinking about selling their farm or retiring from the agricultural business. This exit requires careful planning and consideration to ensure a smooth and successful transition. According to a recent census, 60% of farmers are 55 or older, but only 13% of farmers have written succession plans in place!

In this blog post, we will explore the essential factors that farmers need to consider when they are contemplating selling or retiring from their farming operations, with a specific focus on the lifetime capital gains exemption.

- Understanding the Lifetime Capital Gains Exemption: The lifetime capital gains exemption is a tax provision available to Canadian farmers and fishers. It allows them to claim a tax exemption on the capital gains realized from the sale of qualified farm or fishing property, up to a certain limit. Today, the exemption limit is $1 million. Understanding the details and requirements of this exemption is crucial for farmers considering selling their farm, as it can have a significant impact on their tax payable.

- Eligibility and Qualified Farm Property: To benefit from the lifetime capital gains exemption, farmers must ensure that their property meets the criteria of qualified farm property. Qualified farm property typically includes land, buildings, and equipment used primarily in a farming business. Farmers should review the specific requirements outlined by the Canada Revenue Agency (CRA) and consult with tax professionals to confirm their eligibility and ensure compliance with the exemption rules. I’ve included the current requirements at the end of this blog.

- Tax Planning and Optimization: Farmers considering the sale of their farm should engage in thorough tax planning to optimize the use of the lifetime capital gains exemption. This involves assessing the potential capital gains, considering the available exemption limit, and strategizing to minimize tax liabilities. Working with experienced tax advisors or accountants can help farmers navigate the complex tax rules, identify opportunities for tax minimization, structure the sale in a manner that maximizes the benefit of the exemption and ensures maximum long term wealth preservation.

- Timing the Sale: The timing of the sale can have a significant impact on the utilization of the lifetime capital gains exemption. Farmers should carefully consider their tax situation, personal circumstances, and market conditions when determining the optimal time to sell. Changes in tax laws or regulations may affect the availability or value of the exemption, so staying informed and seeking professional advice is crucial.

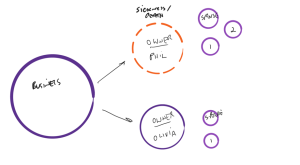

- Transition and Succession Planning: Farmers looking to retire and sell their farm must also consider the implications of the lifetime capital gains exemption for succession planning. If the goal is to transfer the farm to the next generation, structuring the sale in a way that allows for the use of the exemption by both parties can be advantageous. This may involve strategies such as share transfers, leasing arrangements, or implementing a gradual transition plan. Working closely with legal and financial professionals can help ensure a smooth transition while optimizing the tax benefits.

- Professional Guidance: Given the complexities of tax laws and regulations, it is essential for farmers to seek professional guidance when considering the lifetime capital gains exemption. Engaging with tax advisors, accountants, and lawyers experienced in agricultural taxation can provide valuable insights and ensure compliance with the CRA’s requirements. These professionals can also assist in developing a comprehensive tax strategy that aligns with the farmers’ overall retirement and financial goals.

Hopefully by exposing more farmers to articles like this one, we start seeing the percentage of farmers with written succession plans trending higher year over year. If you’re a farmer or if you know a farmer, share this with them and encourage them to seek professional guidance so that they can optimize their retirement planning and ensure a smooth transition to the next phase of their lives.

Below are the current requirements to meet the criteria of qualified farm property for the purpose of the lifetime capital gains exemption:

- Farming Activity: The property must be used primarily in a farming business, meaning that it is actively involved in agricultural production. This includes activities such as cultivating land, raising livestock, growing crops, or producing aquaculture or other agricultural products.

- Ownership: The property must be owned by an individual or a partnership of individuals. Corporations or trusts generally do not qualify for the lifetime capital gains exemption on farm property.

- Duration of Ownership: The property must have been owned and used in a farming business for at least 24 months before the disposition (sale) occurs. However, in some cases, the CRA allows for a shorter ownership period if there were circumstances beyond the farmer’s control that prevented meeting the 24-month requirement.

- Nature of the Property: The property must meet specific nature criteria to qualify as qualified farm property. The following requirements generally apply:

- Buildings and Structures: Buildings and structures, such as barns, storage sheds, or silos, that are used primarily in the farming business can qualify as part of the qualified farm property.

- Shares of a Family Farm Corporation: Shares of a family farm corporation can be considered qualified farm property if certain conditions are met, including that the majority of the assets of the corporation are qualified farm property and that the shares are owned by individuals who meet specific eligibility criteria.

- Farming Income Test: The farming income test requires that farming income, either alone or in combination with farming income of a spouse or common-law partner, exceed other income (excluding taxable capital gains) in at least two out of the last five years. This ensures that the lifetime capital gains exemption is primarily available to farmers and not individuals who may own farm property but do not actively engage in farming activities.

If you are a farmer, and you are contemplating selling or retiring from your farming operations, or if you would like to set up a succession plan, click HERE to book an appointment with us today!

![The hardest topic most business owners haven’t talked about [yet].](https://www.ecivda.com/wp-content/uploads/2023/02/the-hardest-topic-1.png)

By: Shawn Todd, CFP

By: Shawn Todd, CFP

By: Corey Butler, Wealth Advisor

By: Corey Butler, Wealth Advisor