Mortgage Protection vs Life Insurance

By: Louai Bibi, Advisor Associate

Should I get mortgage protection or life insurance?

If you have a mortgage, your mortgage lender has likely brought this up to you, and for good reason.

It’s important to have insurance when you have people who depend on your income, whether it is a spouse and/or child. It’s also important that you know what you are paying for and how it may or may not benefit you.

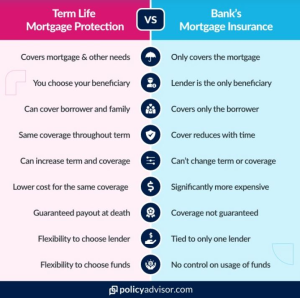

Term insurance is generally cheaper, allows for you to cover other insurance needs like leaving behind income replacement for your spouse or ensuring your children experience a fully funded post-secondary education if you aren’t around to contribute to their RESP, and allows you to structure coverage for a shorter, longer or permanent period as insurance needs change.

With mortgage protection through your bank/mortgage lender, your coverage reduces as you pay your mortgage down (which makes sense in theory, until you realize your insurance payment stays the same), the bank is the sole beneficiary of that money and every time you renew or switch lenders, you need to re-apply this coverage to your mortgage and are subject to whatever increase in cost is offered.

These are just a few differences between the two products. More listed in the snapshot below!