Canada Pension Plan (CPP): When should you start collecting?

By Louai Bibi, Advisor Associate

Should you take your Canada Pension Plan (CPP) as early as possible, at the default retirement age of 65 or defer to age 70? I have included a handy calculator before to help us find out!

Click HERE

With this calculator, you’ll be able to map out at what age you’ll breakeven on taking CPP at age 65 vs 70. In this example, the breakeven age is 75 for a 50 year old. If this individual has a life expectancy of 75 years or less, it is more optimal to take CPP early on paper. If their life expectancy is > than age 75, they may be better off deferring to maximize the monthly pension amount.

The beauty of this calculator is that you can plug in your age, life expectancy (you can use the average of 84 for men, 87 for women), the rate of return your investments are achieving if you were to collect early & invest some/all of the monthly pension, the rate of inflation and benchmark a “start collecting early” versus a “start collecting late” scenario.

The reality is that we don’t have a crystal ball to know whether we’ll live to age 75 or 100, so we can’t base these decisions purely off the most optimal number a calculator spits out, which is where the qualitative considerations come in.

You may want to spend more money in retirement to visit your loved ones or check off some of the exciting items on your bucket list. I for one, would not want to wait 5 or 10 years to receive my optimally deferred pension to do these things, as long as my retirement/estate plan is sustainable and I know I won’t run out of money.

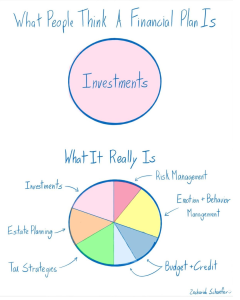

This is where we come in – whether it is Shawn, Corey, Mike, or myself. We help bridge the gap between what the calculator spits out and the values/motivations that prompted you to open that calculator in the first place. You are never too young or old to start planning for financial independence/retirement but like most things in life, it’s generally easier when you start early. You can book yourself into any of our calendars or reach out via email if you’d like advice on building out a financial plan.

Click HERE

You spend your entire working career accumulating retirement savings, but it seems that we forget that we have a right to spend it. The calculator is a great way to start this conversation, but not the way to end it!

Most optimal does not always = most appropriate!