What Happens If You Never Create a Succession Plan?

What Happens If You Never Create a Succession Plan?

By Shawn Todd, CFP

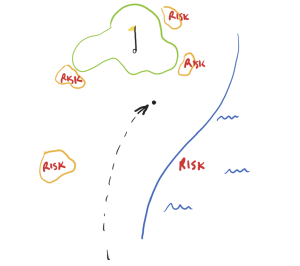

There’s a silent, slow-moving risk that many business owners face. It doesn’t show up in the income statement, and it doesn’t flash red on a dashboard.

But it’s real. It can destroy their business, and it’s often overlooked. It’s succession uncertainty.

And I know the cost of it firsthand.

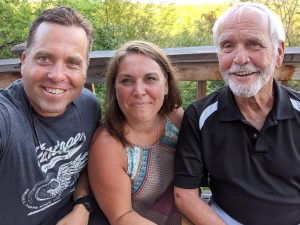

My Story. From 3 Years to 16: The Long Transition That Almost Didn’t Finish

When my stepfather Brian and I first discussed a transition plan, the idea was simple: a 3- to 5-year succession of his financial planning business. We mapped out a phased strategy where I would slowly take the reins while Brian prepared for a well-earned retirement.

Except, that timeline stretched. And stretched again.

The business grew—and I mean really grew. New clients, more complexity, bigger opportunities. With all that momentum, the idea of stepping away felt impossible. Brian loved the work, the people, the mission. How could he walk away at the peak of what he’d built?

So what started as a 5-year plan turned into a 16-year journey.

And then everything nearly collapsed.

Almost a Crisis. The Wake-Up Call: Health and the Unexpected

Months before the purchase was finalized—and I mean we were right there—Brian was diagnosed with a serious heart condition. Heart surgery was scheduled. The deal froze.

We had worked so hard, for so long, to get it right. But in a heartbeat, the entire transition was at risk.

What if something had happened to Brian?

Suddenly, every intention we had could’ve crumbled. His clients—people he’d spent decades advising—could’ve faced exactly what he didn’t want: a chaotic, rushed, and impersonal handoff.

That’s when it hit me. Succession planning without an emergency transition plan is like climbing a mountain without a harness. It might work—until the moment it doesn’t.

We had to have the hard chats. “What are we going to do – if you die Brian?”, “What do you want Mom to have?”, “Who is going to run the company? Pay the employees?”

Lesson One: Succession Is Not Just About Retirement

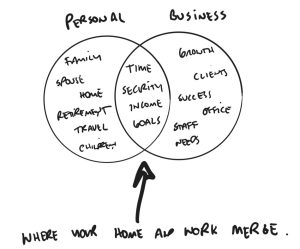

Succession is about continuity. It’s about ensuring that the people who depend on you—your clients, your team, your family—are taken care of if life throws a curveball.

Retirement is only one potential exit.

Health. Family emergencies. Even unexpected offers to sell. All of these can arrive earlier than planned. And if your business isn’t prepared, the damage isn’t just financial—it’s emotional and reputational.

We had spent years building a reputation and a business.

We weren’t going to allow it to stop there.

Lesson Two: You Need a Plan for the Plan

After [and in the middle of] our health scare, I sat down and built a full Emergency Transition Plan—something we now use with our clients and peers. This isn’t just a document. It’s a roadmap. It outlines:

- Who takes over what

- How clients are communicated with

- What systems are in place to maintain trust and operations

- And what happens in the first 72 hours

We’ve now guided multiple business owners through this exact conversation, from financial advisors to family businesses. And time and again, I’ve seen the power of this kind of clarity.

It’s a must have document for every business.

Who gets the first call after your family finds out you’ve had a stroke?

Who is the 20 clients that can’t find out by email that you’ve passed away?

What risks does your business stand in the event of your death or disability? How much reveue drop will there be? What systems are in place?

Lesson Three: You Don’t Have to Do It Alone

I’m grateful to mentors like JD Lanctin and Kim Siegers, who helped me think deeply and critically about the gaps in most succession strategies, including ours. Their insights pushed us to build a program that’s more than legal documents—it’s a way to protect legacy, relationships, and peace of mind.

Because no one wants to spend 30 years building something meaningful, only to have it unravel in six months, or six minutes.

Final Thoughts: The Cost of Inaction Is Too High

If you’re a business owner without a succession or emergency plan, you’re not just risking your business—you’re risking the relationships it supports.

The conversation might feel awkward.

It might feel premature.

But trust me—waiting until you’re “ready” is most likely already too late.

Create the plan.

Build the transition.

Give your future, and the people who rely on you, the safety they deserve.

One of the things that strikes me as incredibly common about both my experience, and the experiences that I have had with clients, is that its difficult to talk about what might happen if we get sick, or if we die. It’s terrifying.

One of the things that strikes me as incredibly common about both my experience, and the experiences that I have had with clients, is that its difficult to talk about what might happen if we get sick, or if we die. It’s terrifying.

![The hardest topic most business owners haven’t talked about [yet].](https://www.ecivda.com/wp-content/uploads/2023/02/the-hardest-topic-1.png)

By: Shawn Todd, CFP

By: Shawn Todd, CFP