Old World Views Modern Approach

You have different needs, aspirations & goals

What is your personality style?

Conservative, Adventurous, Disciplined, Methodical, Spontaneous, Cautious, Individualist, Growth Focused, Ambitious

What are your lifestyle needs?

Travelling in retirement? Focus on your business growth? Enjoying your life? Looking after your family? Ensuring your employees are secure? Grandchildren? Building a legacy? Passing on or selling your business? Requiring more income or better management today?

Our Focus Is On You

Life’s most precious asset is time. We give you time.

Wisdom is the reward of experience and should be shared.

Unlocking the Power of the RDSP: A Lifeline for the Future

Unlocking the Power of the RDSP: A Lifeline for the Future

By Corey Butler

Imagine a savings plan so powerful, the government not only matches your contributions but sometimes gives you money even if you don’t put in a cent. Welcome to the Registered Disability Savings Plan (RDSP)—a little-known but life-changing financial tool available to Canadians living with disabilities.

For families navigating the added costs and uncertainties that often accompany disability, the RDSP is more than just another bank account—it’s peace of mind, security, and a way to build a future with dignity and independence.

What Is the RDSP, and Why Should You Care?

Launched in 2008, the RDSP is a federally registered savings plan designed to help people with disabilities build long-term financial security. It’s similar in some ways to a retirement plan, but tailor-made to support individuals who qualify for the Disability Tax Credit (DTC).

What makes it remarkable? Free government money. Through a combination of grants and bonds, the government can contribute up to $90,000 over the lifetime of the plan.

This isn’t just smart saving. It’s strategic empowerment.

Who’s Eligible?

To open an RDSP, a person must:

- Be under 60 years old

- Be a Canadian resident

- Have a Social Insurance Number (SIN)

- Be approved for the Disability Tax Credit (DTC)

Parents or guardians can open the account on behalf of a child, and contributions can be made by family or friends—anyone looking to invest in the future of someone they care about.

The Two Magic Words: Grants and Bonds

Canada Disability Savings Grant (CDSG)

This is a government match program that can triple your contributions. For lower- and middle-income families, the government will contribute up to $3 for every $1 saved, depending on income and amount contributed. Over a lifetime, you can receive up to $70,000 in grants.

Canada Disability Savings Bond (CDSB)

Even if you can’t afford to contribute, the government may still deposit up to $1,000 per year into the plan—no personal savings required. That’s up to $20,000 for those with lower incomes.

Smart Money, Tax-Free Growth

The RDSP allows savings to grow tax-free, and withdrawals are designed to supplement—not replace—income and disability benefits. That means you can plan for the future without risking access to vital programs like the Guaranteed Income Supplement (GIS), Old Age Security (OAS), or provincial social assistance.

In fact, in most provinces, money held in an RDSP is fully exempt from asset and income testing—making it a rare and powerful exception in the financial world.

Can You Access the Money?

Yes—but with caveats. The RDSP is meant for long-term use, so early withdrawals come with potential clawbacks. Any grants or bonds received in the 10 years prior to withdrawal may need to be partially repaid.

After age 60, beneficiaries can begin receiving regular payments without penalty, creating a steady source of income during retirement or later life stages.

Getting Started: No Experience Required

Setting up an RDSP is easier than it sounds:

- Get approved for the Disability Tax Credit (DTC).

- Visit a financial institution that offers RDSPs (most major banks do).

- Open the account and apply for the grants and bonds.

- Start contributing—if you can. Even small deposits can unlock thousands in support.

The Bottom Line

In a country with universal health care and social safety nets, the RDSP stands out as one of the most generous and empowering programs for people with disabilities. And yet, it remains underused and often misunderstood.

If you, your child, or someone you know is eligible, don’t wait. This is a rare opportunity to secure a future on your own terms—with help from a system that, for once, truly works in your favour.

Corey Butler

To see this blog published in the Mingo Magazine Fall 2025 issue – click HERE

What Happens If You Never Create a Succession Plan?

What Happens If You Never Create a Succession Plan?

By Shawn Todd, CFP

There’s a silent, slow-moving risk that many business owners face. It doesn’t show up in the income statement, and it doesn’t flash red on a dashboard.

But it’s real. It can destroy their business, and it’s often overlooked. It’s succession uncertainty.

And I know the cost of it firsthand.

My Story. From 3 Years to 16: The Long Transition That Almost Didn’t Finish

When my stepfather Brian and I first discussed a transition plan, the idea was simple: a 3- to 5-year succession of his financial planning business. We mapped out a phased strategy where I would slowly take the reins while Brian prepared for a well-earned retirement.

Except, that timeline stretched. And stretched again.

The business grew—and I mean really grew. New clients, more complexity, bigger opportunities. With all that momentum, the idea of stepping away felt impossible. Brian loved the work, the people, the mission. How could he walk away at the peak of what he’d built?

So what started as a 5-year plan turned into a 16-year journey.

And then everything nearly collapsed.

Almost a Crisis. The Wake-Up Call: Health and the Unexpected

Months before the purchase was finalized—and I mean we were right there—Brian was diagnosed with a serious heart condition. Heart surgery was scheduled. The deal froze.

We had worked so hard, for so long, to get it right. But in a heartbeat, the entire transition was at risk.

What if something had happened to Brian?

Suddenly, every intention we had could’ve crumbled. His clients—people he’d spent decades advising—could’ve faced exactly what he didn’t want: a chaotic, rushed, and impersonal handoff.

That’s when it hit me. Succession planning without an emergency transition plan is like climbing a mountain without a harness. It might work—until the moment it doesn’t.

We had to have the hard chats. “What are we going to do – if you die Brian?”, “What do you want Mom to have?”, “Who is going to run the company? Pay the employees?”

Lesson One: Succession Is Not Just About Retirement

Succession is about continuity. It’s about ensuring that the people who depend on you—your clients, your team, your family—are taken care of if life throws a curveball.

Retirement is only one potential exit.

Health. Family emergencies. Even unexpected offers to sell. All of these can arrive earlier than planned. And if your business isn’t prepared, the damage isn’t just financial—it’s emotional and reputational.

We had spent years building a reputation and a business.

We weren’t going to allow it to stop there.

Lesson Two: You Need a Plan for the Plan

After [and in the middle of] our health scare, I sat down and built a full Emergency Transition Plan—something we now use with our clients and peers. This isn’t just a document. It’s a roadmap. It outlines:

- Who takes over what

- How clients are communicated with

- What systems are in place to maintain trust and operations

- And what happens in the first 72 hours

We’ve now guided multiple business owners through this exact conversation, from financial advisors to family businesses. And time and again, I’ve seen the power of this kind of clarity.

It’s a must have document for every business.

Who gets the first call after your family finds out you’ve had a stroke?

Who is the 20 clients that can’t find out by email that you’ve passed away?

What risks does your business stand in the event of your death or disability? How much reveue drop will there be? What systems are in place?

Lesson Three: You Don’t Have to Do It Alone

I’m grateful to mentors like JD Lanctin and Kim Siegers, who helped me think deeply and critically about the gaps in most succession strategies, including ours. Their insights pushed us to build a program that’s more than legal documents—it’s a way to protect legacy, relationships, and peace of mind.

Because no one wants to spend 30 years building something meaningful, only to have it unravel in six months, or six minutes.

Final Thoughts: The Cost of Inaction Is Too High

If you’re a business owner without a succession or emergency plan, you’re not just risking your business—you’re risking the relationships it supports.

The conversation might feel awkward.

It might feel premature.

But trust me—waiting until you’re “ready” is most likely already too late.

Create the plan.

Build the transition.

Give your future, and the people who rely on you, the safety they deserve.

What I’ve Learned from 20 Years of Working with Business Owners on the Edge of Retirement

What I’ve Learned from 20 Years of Working with Business Owners on the Edge of Retirement

By Shawn Todd, CFP

There’s something humbling about sitting across the table from a busines

s owner who’s built something from scratch. Maybe it’s a thriving construction company, a medical practice, or a family-run restaurant. The business might be wildly successful or just finally gaining traction—but in almost every conversation, I hear the same thing:

“I wish I had started planning for myself sooner.”

It’s something I understand not just professionally—but personally.

I grew up surrounded by business owners. My mother and stepfather both ran their own businesses. My dad built a business on the side. My sister has run several successful businesses. My cousin started a very successful & growing online company. I started a business with my stepfather, my uncle was a business owner, and my grandfather ran two farms. I incorporated my first business at 26, after drawing up a logo on the back of a business card and getting a small $7,000 loan. How hard could business ownership be?

In short, entrepreneurship is part of my DNA. But so is seeing the cost when financial planning gets pushed to the back burner.

After 20 years of walking alongside business owners approaching retirement, here are some of the most important lessons I’ve learned—lessons I wish more people talked about earlier in the journey.

1. You’re Not Just Building a Business—You’re Building a Life

Too many business owners spend their best years reinvesting in the company, skipping vacations, and putting off key conversations at home because “the business needs them.” But if you don’t align your business with your life goals, you risk waking up one day with money and no map.

The best outcomes happen when business and personal goals are planned in sync—when you view your company as a tool to fund your freedom, not just your workload.

2. Your Business Can Be a Legacy—or a Liability

I’ve seen it too many times: someone’s poured 30 years into a business… only to have no plan to exit, no valuation, and no buyer. That turns a potential legacy into a long list of regrets.

Business succession isn’t just a legal conversation—it’s a deeply emotional one. Who will carry on what you’ve built? Is it a partner? A child? An external buyer? Starting early gives you the most options—and peace of mind for everyone involved.

3. Cash Flow and Profit Aren’t the Same as Financial Clarity

Many owners think, “I must be doing okay—I’m not struggling to pay the bills.” But clarity goes beyond surviving.

It means understanding:

- What you own (and what it’s worth)

- What your business contributes to your retirement

- What your tax exposure really looks like

- And what your family needs from all this

You don’t need to be an expert—but you do need a clear picture. Without it, every decision feels like a guess.

4. Your Family Is Watching—and Waiting

Business owners often carry the weight alone. Your spouse may not ask, the kids don’t know what to say, and you assume silence equals peace.

But silence usually equals stress.

When I meet with families, I hear the same fears:

- “What happens if something happens to them?”

- “Is the business our retirement plan?”

- “Are we safe if they step away?”

One of the greatest gifts you can give your family isn’t money—it’s clarity and communication. As I’ve grown my business – I’ve learned that really good conversations and insight come from home. My spouse Michele has often been a great sounding board for some of my ideas, and has been the provider of great wisdom over many years. It’s a relationship & dynamic that I truly appreciate.

5. Your Network Is Gold—So Learn from It

I’ve learned more from business owners in real conversations than I ever did in textbooks. I’ve seen what works, what fails, and what haunts people.

Some of the best business owners I’ve met I either was lucky to work for, or work around. I learned tons of lessons on quality of work, discipline, and belief in your vision.

When Corey & I started the podcast – we originally wanted to open the dialogue to include some of the amazing business owners we meet. Let them tell their stories. Since then, some of these incredible conversations have turned into really great and valuable lessons for us both.

So, take the time to talk to the people around you. Ask your peers what they regret. Ask what they wish they did differently. And if you don’t have someone you trust to ask… then find one.

Because at the end of the day, you don’t have to figure this out alone.

Final Thought: It’s Never Too Late, But Sooner is Always Better

Whether you’re 10 years from retirement or 6 months from a deal closing—clarity brings peace. And clarity comes from planning.

If you’ve spent your career building a business, maybe it’s time to start building your future with the same level of intention.

Canada’s Unemployment Rate Hits 7%: What It Means for You and the Markets

Canada’s May 2025 Unemployment Rate Hits 7%: What It Means for You and the Markets

By: Rushit Goyani, RFRA

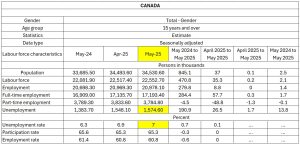

In May 2025, Canada’s unemployment rate rose to 7.0%, the highest in nine years outside the pandemic. This signals a slowing job market, with more people looking for work and fewer new jobs being created.

What Is the Unemployment Rate?

The unemployment rate shows the percentage of people in the labor force who are jobless but actively looking for work. It is a key economic signal used to measure how strong or weak the job market is at any time.

What Happened in May 2025?

Unemployment rose slightly from 6.9% in April to 7.0% in May, meaning job growth is no longer keeping up with population growth. While some jobs were added overall, key industries like manufacturing lost positions due to economic pressures, including U.S. trade tariffs.

Source: – Statistic Canda

More Canadians are staying unemployed for longer, with the average job search now taking over 21 weeks. That is a clear sign the labor market is tightening, and opportunities are becoming harder to find. Below is a month-on-month comparison for unemployment data.

Source: Trading Economics / Statistics Canada

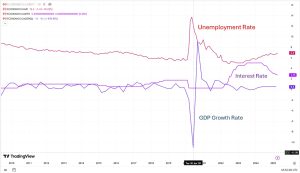

In Canada, an increase in the unemployment rate is generally seen as a sign of economic weakening, often prompting the Bank of Canada to reassess its monetary policy stance. This trend indicates that job creation is not keeping pace with the country’s growing population, suggesting a cooling labour market.

To counteract such economic slowdowns, the Bank of Canada may opt to lower its benchmark interest rate in an effort to encourage borrowing, spur investment, and drive employment growth. However, this strategy must be weighed against the potential for inflation. For example, as of June 2025, the Bank chose to hold its key rate steady at 2.75%, despite signs of an economic slowdown. This decision was largely influenced by the uptick in core inflation, which had climbed to 3.15% in April, exceeding the central bank’s comfort zone.

This cautious approach highlights the challenges involved in setting monetary policy amid mixed economic signals. Although rising unemployment would usually justify easing interest rates, sustained inflation can limit the Bank’s flexibility. Consequently, the Bank of Canada must navigate a delicate balance, factoring in a range of economic indicators to ensure financial stability and support long-term growth.

Below is a long-term chart of the unemployment rate, interest rate, and GDP growth rate.

Why It Matters: Bonds and Stocks

Bond Market Effects

When unemployment rises, central banks may lower interest rates to support the economy. Lower rates tend to boost bond prices, as investors shift to safer, more stable returns during uncertain times.

Stock Market Effects

Higher unemployment can hurt company profits, as fewer people working means lower consumer spending. But if markets expect interest rate cuts, that could help stocks rise by making borrowing cheaper and boosting confidence.

Key Takeaways

- 7.0% unemployment shows Canada’s economy is slowing and job creation is not keeping pace.

This may lead the Bank of Canada to adjust interest rates to avoid further economic weakening. - Bond markets often respond positively to rising unemployment because it suggests future rate cuts.

As a result, bond investors may see rising prices if the central bank shifts to a more supportive stance. - Stock markets face uncertainty, balancing the negative effect of weaker earnings with the potential benefit of lower interest rates.

The reaction depends on whether investors believe the slowdown is short-term or a longer economic trend. - Investors should watch for Bank of Canada updates and labor market trends.

These signals help forecast economic direction and how both bonds and stocks might behave.

Bottom line: Canada’s rising unemployment rate is a sign of economic slowdown. It affects everyday people, financial markets, and policy decisions—so it is a number worth watching.

What can we do for your business?

From helping you better understand how a strong employee benefits program can help your business grow, to assisting you protect a key employee, through to designing a customized owner compensation strategy, we can assist in strengthening your position in the marketplace.

How’s your relationship with your financial planner or advisor?

You’re here as you are looking for a team who can help with your specialized needs and understand your goals. It’s taken a lifetime to accumulate your wealth, and it’s important to get this right. To have the right fit.

Read what our clients have to say

I highly recommend Mike and the rest of the Ecivda team to anyone in search of financial planning with utmost confidence.

Also, his receptionist Jackie is wonderful. She goes above and beyond to ensure you are satisfied with your service at Ecivda. Thank you Shawn and Jackie!!